Section 1.0

<

1.0 Section

Yield Tokenization and Bond Stripping

1 of 2

>

Yield Tokenization and Bond Stripping

In traditional finance, bond stripping is the practice of separating the principle

and coupon payments of a debt obligation and selling the two components separately.

The principle represents the bond itself, while the coupon represents the interest

rate of the bond.

Yield Tokenization emulates this process on-chain by stripping a yield-bearing asset

into two components:

YT

Yield Token

PT

Principle Token

100 ATOM Staked

After (3) Months

Principal

100 ATOM

+

Yield

0.5 ATOM

100 stATOM

Yield bearing Position

100 ATOM

Principal Tokens

100 PT stATOM

After (3) Months

100 ATOM

Principal

99.501 stATOM

Yield Tokens

100 YT stATOM

After (3) Months

0.5 ATOM

Yield

0.499 stATOM

Section 1.1

<

1.1 Section

How does Yield Tokenization Work?

2 of 2

>

How does Yield Tokenization Work?

When a user stakes a token in any DeFi protocol, they will receive some amount of

yield. With Yield Tokenization, the staked position is separated into its two

components, YT and PT.

Let's say a user stakes their tokens for 3 months:

By holding PT

a user can redeem the principal amount (token value) after maturity. In this

case, after 3 months.

By holding YT

a user can receive the yield of the staked token(s) after maturity. In this

case, after 3 months.

Yield bearing Position

100 stATOM

Principal Tokens

100 PT stATOM

Can redeem the Principal after maturity

Yield Tokens

100 YT stATOM

Can redeem the Yield after maturity

99.501 stATOM

0.499 stATOM

Section 2.0

<

2.0 Section

Yield Tokenization in Detail

1 of 3

>

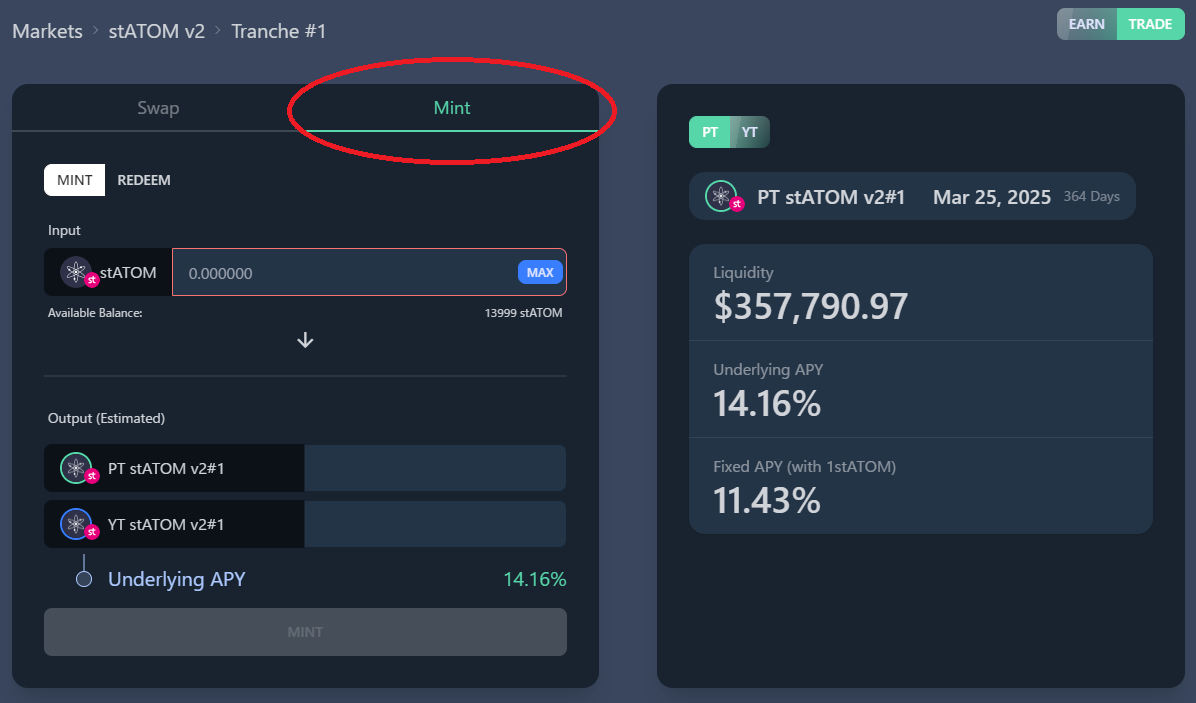

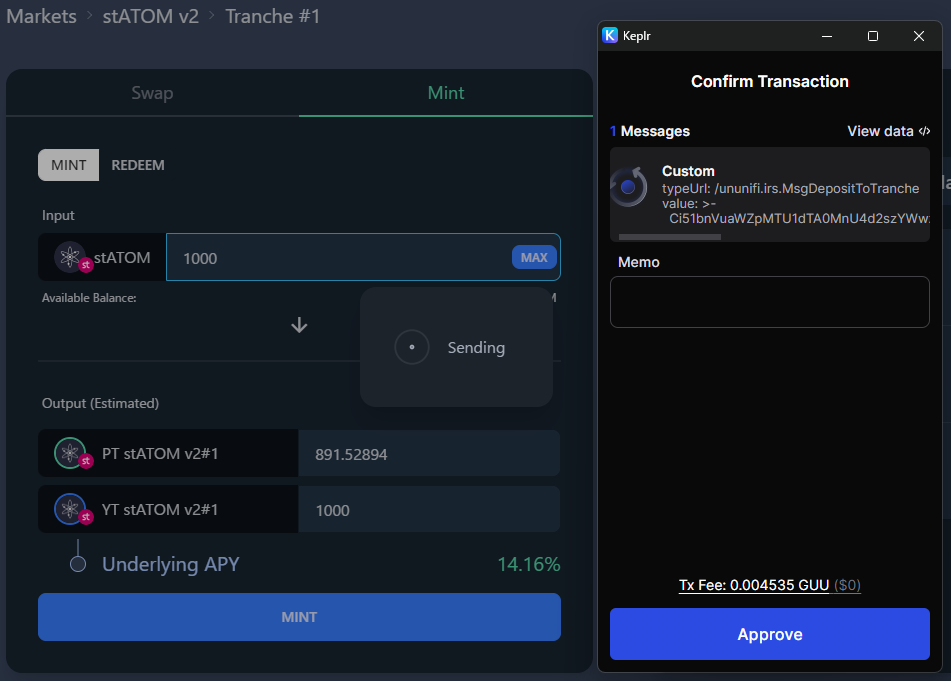

Yield Tokenization in Detail

For every yield-bearing position, there is the underlying asset. In this example, we

will use ATOM. Maturity in this context is defined as the length of time the

underlying asset is staked. The Fixed Yield vault will allow users to deposit stATOM

(Stride liquid staked ATOM) which will then be separated into its components. Since

the underlying asset for stATOM is ATOM, it can be inferred that manipulating an

stATOM position is the same as manipulating an ATOM position.

i

Through yield tokenization:

1 stATOM

XX* PT stATOM

+

100 YT stATOM

PT st ATOM

The principal amount of the underlying asset (ATOM)

YT stATOM

The yield generated by the underlying asset (ATOM)

$

PT

Price +

YT

Price = Underling Asset Price

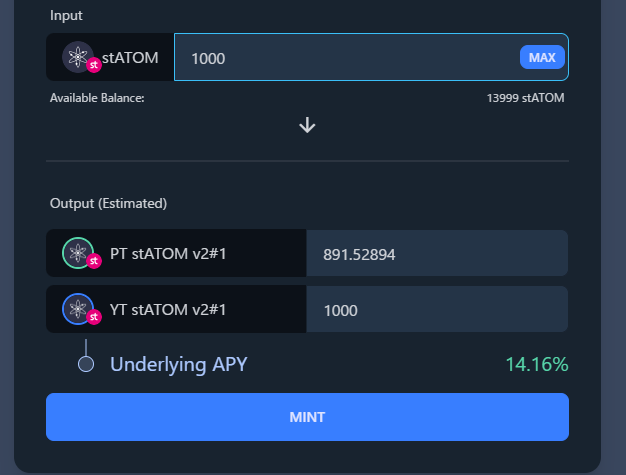

Let's say a user stakes their tokens for 3 months:

Before Maturity

a user can use 1 underlying asset to mint XX PT + 1 YT

- The amount of PT a user can mint decreases as we approach maturity, this value is represented as XX

- The value of PT stATOM increase as we approach maturity

After Maturity

the yield for the position has been earned, therefore:

- Yield earned from holding YT can be redeemed at maturity

- YT value will have appreciated due to auto-compounding

- After maturity, 1 PT can be redeemed for the underlying asset 1:1 without needing YT

Additionally, PT and YT can be bought and sold openly on the secondary market,

Introducing the opportunity for Yield Trading.

A

Before Maturity

You can mint XX* PT and 1YT from 1 units

of the underlying asset.

Yield bearing Position

100 stATOM

mint

Maturity:December 2023

XX* PT stATOM

*The value of PT stATOM increases as we approach maturity, with a max value

of xx=1

100 YT stATOM

Maturity:December 2023

B

Before Maturity

You can sell on the secondary market to receive the underlying asset

Maturity:December 2023

XX* PT stATOM

Maturity:December 2023

100 YT stATOM

Must sell on

Gluon AMM

XX* ATOM

*Value determined by

current market rate

C

After Maturity

YT holders

can redeem any yield accrued after maturity.

1st January

Buys 100 YT stATOM

Maturity December 2023

Maturity

Maturity

After Maturity

Redeems Yield

from 100 ATOM

D

After Maturity

PT holders can redeem underlying assets 1:1

without YT

1st January

Buys 100 PT stATOM

Maturity December 2023

Maturity

Maturity

After Maturity

Redeems

from 100 ATOM

C

Before Maturity

You can buy and sell PT and YT on the open market using Gluon AMM. (This is

Yield Trading) As such, PT and YT will always have a market price.

NOTE: YOU CAN NOT CLAIM YIELD UNTIL AFTER MATURITY

Section 2.1

<

2.1 Section

How YT values change over time

2 of 3

>

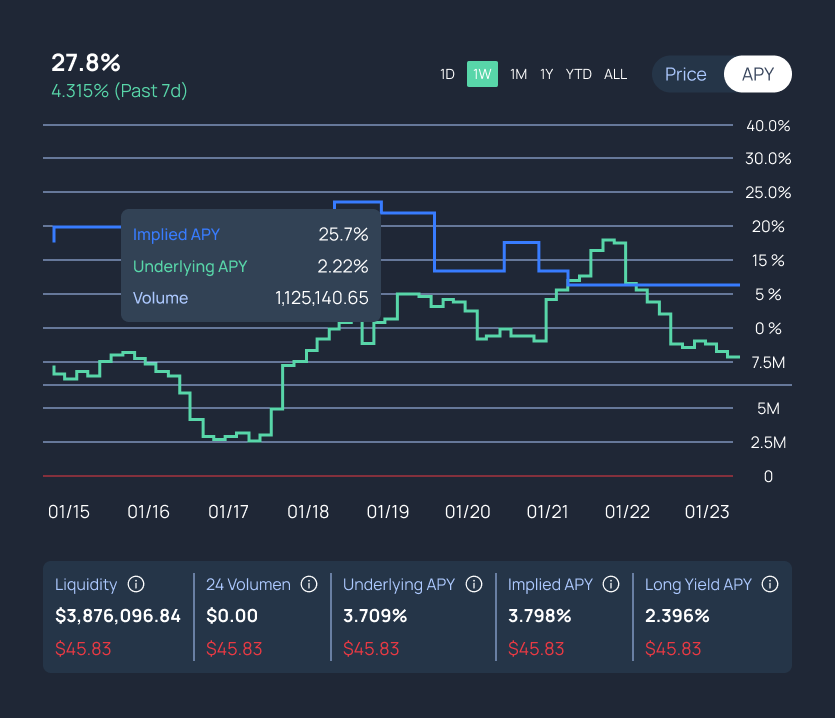

How YT values change over time

In Yield Tokenization protocols without auto-compounding yield, a user can redeem

yield at any time prior to maturity. In auto-compounding yield tokenization

protocols such as Gluon Trade, the yield auto-compounds and is reflected as a steady

increase in the value of YT, proportional to the yield earned.

As a result of this continuous increase in the value of YT, the protocol must offset

this value by decreasing the amount of PT minted by a deposit, also based until time

to maturity.

Without Auto-compounding Yield:

- PT increases in value as we approach maturity, PT minted remains 1:1

- YT decreases in value as we approach maturity, YT minted remains 1:1

With Auto-compounding Yield:

- PT increases in value as we approach maturity, PT minted decreases as we approach maturity

- YT increases in value as we approach maturity, YT minted remains 1:1

(Since YT accumulates value over time, this can be considered as a principal

accumulated by YT)

Section 2.2

<

2.2 Section

How PT values change over time

3 of 3

>

How PT values change over time

Remember our formula:

1 ATOM

XX PT stATOM

+

1 YT stATOM

At maturity

1 PT stATOM

1 ATOM

This means the maximum PT that can be minted is 1:1 with the underlying ( XX = 1 ).

Please note in real world use XX value will fluctuate, and it may be impossible to

mint the max value of XX.

In circumstances when YT has already accumulated some principal value, the protocol

will mint PT less than 1:1 with its underlying component. ( XX < 1 )

Example:

-

99 stATOM = 100 ATOM = 99 PT stATOM + 100 YT stATOM

(YT has already accumulated 1 ATOM worth of additional principal) - At Maturity: 99 PT stATOM = 99 ATOM

- At Maturity: 100 YT stATOM = Yield Earned + Additional yield earned from auto-compounding = 99 stATOM - 99 ATOM

Section 3.0

<

3.0 Section

Interest Rate Swaps and Fixed Yield Tranche

1 of 2

>

Interest Rate Swaps and Fixed Yield Tranche

First, let’s discuss Interest Rate Derivatives: a financial instrument with a value

based on some underlying interest rate or interest bearing asset. These instruments

can include futures, options, swaps, and more.

Swaps, or Interest Rate Swaps (abbreviated IRS) is a type of derivative where one

stream of future interest payments is exchanged for another based on a specified

principal amount.

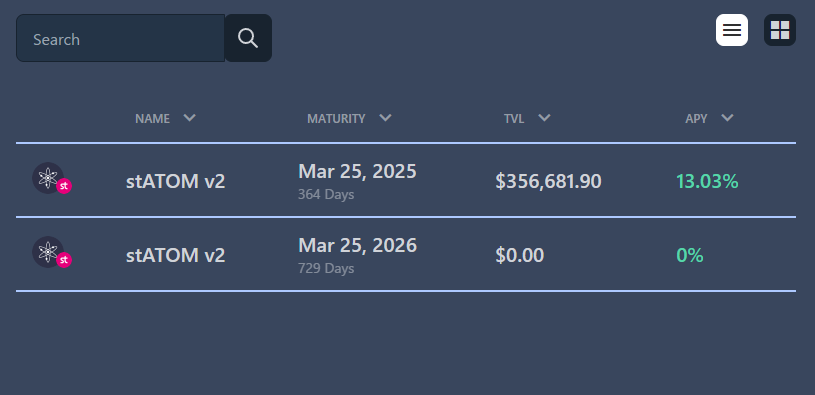

Separately, a Tranche is a segment created from a pool of assets, with these

segments being divided up based on risk, time to maturity, and other

characteristics.

Therefore, a Fixed Yield Tranche is a type of Interest Rate Swap in which the

interest generated from a specified principal amount is swapped for a guaranteed

fixed yield. Users wishing to earn FY without exposure to variable yield can simply

acquire FY directly (without first acquiring the underlying asset). Additionally,

with Fixed Yield, there is zero default risk (no impermanent loss).

Fixed Yield = FY

Fixed Yield = FY

Section 3.1

<

3.1 Section

Where does Fixed Yield come from?

2 of 2

>

Where does Fixed Yield come from?

How is it Calculated?

How is it Calculated?

Remember that with Yield Tokenization, a yield-bearing asset is split into its

underlying components, PT & YT. As a staked position approaches Maturity, a YT

continues to increase in value, with all yield earned also being redeemable at

Maturity. Meanwhile, PT grows in value until it is equal 1:1 with the underlying

asset (at Maturity).

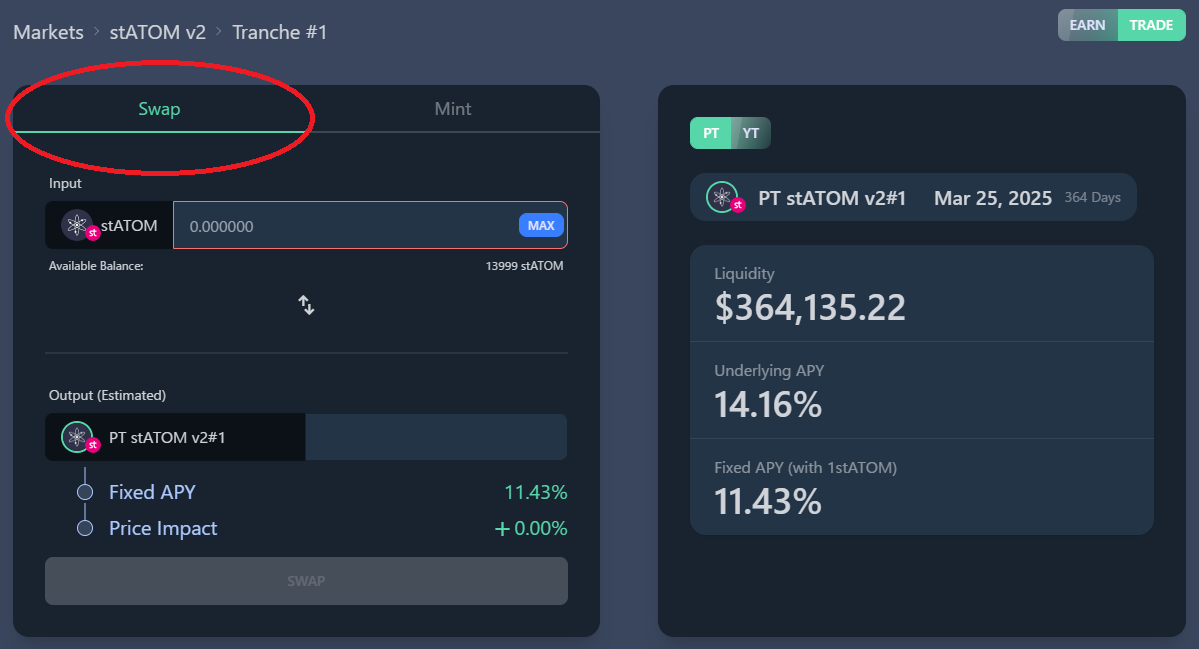

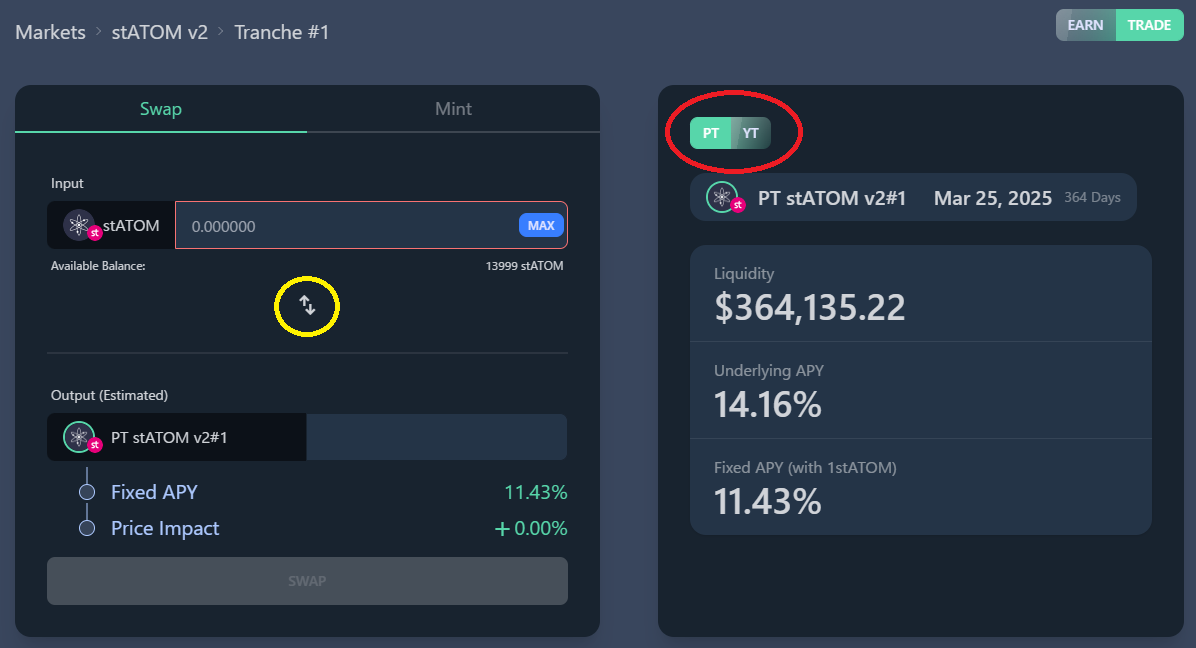

FY represents this change in value for PT. Since PT and YT can be traded on the open

secondary market, users can simply purchase PT without YT.

Buying PT directly (long PT) earns the user fixed yield if they hold the position

until its Maturity date. Buying PT directly (pre-maturity) will always be cheaper

than buying the underlying asset, and the realized discount becomes the fixed yield.

You can buy or sell Principal Token (PT) in the Gluon AMM. PT Price is determined by

market demand and supply

Buys or Sells PT

Gluon AMM

1 PT stATOM =

0.99 ATOM

Example: a user is buying PT for ATOM liquid staked

in Stride (stATOM), also known as PT stATOM. Since PT stATOM does not include the

yield component, PT stATOM will always be cheaper than 1 stATOM.

This is true for all PT.

After buying 1 PT stATOM at a discounted price (0.9 stATOM), User can redeem 1

stATOM for his PT upon maturity. This is a fixed return (fixed yield) since the

amount of stATOM redeemable at maturity is fixed.

Buys 1 PT stATOM

at 0.9 stATOM

1 Year Later

User gets 11% APY

Maturity

Maturity

Redeems 1 stATOM

Section 4.0

<

4.0 Section

Yield Trading

1 of 4

>

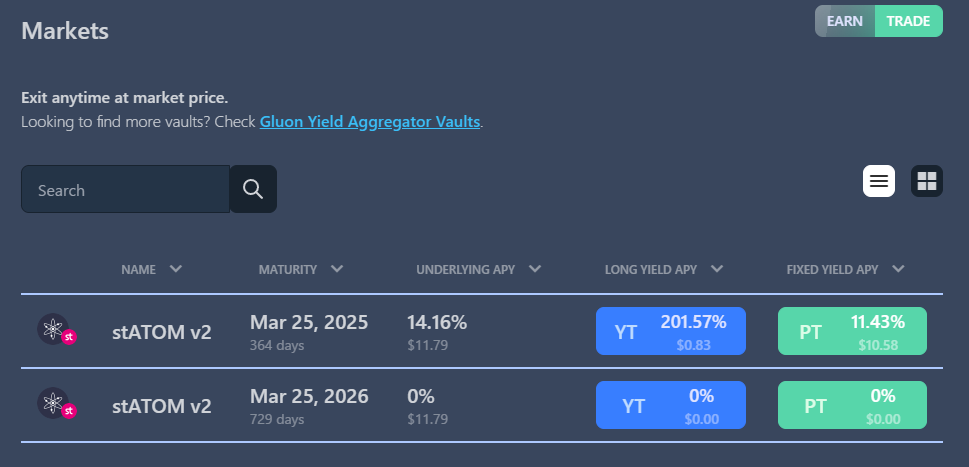

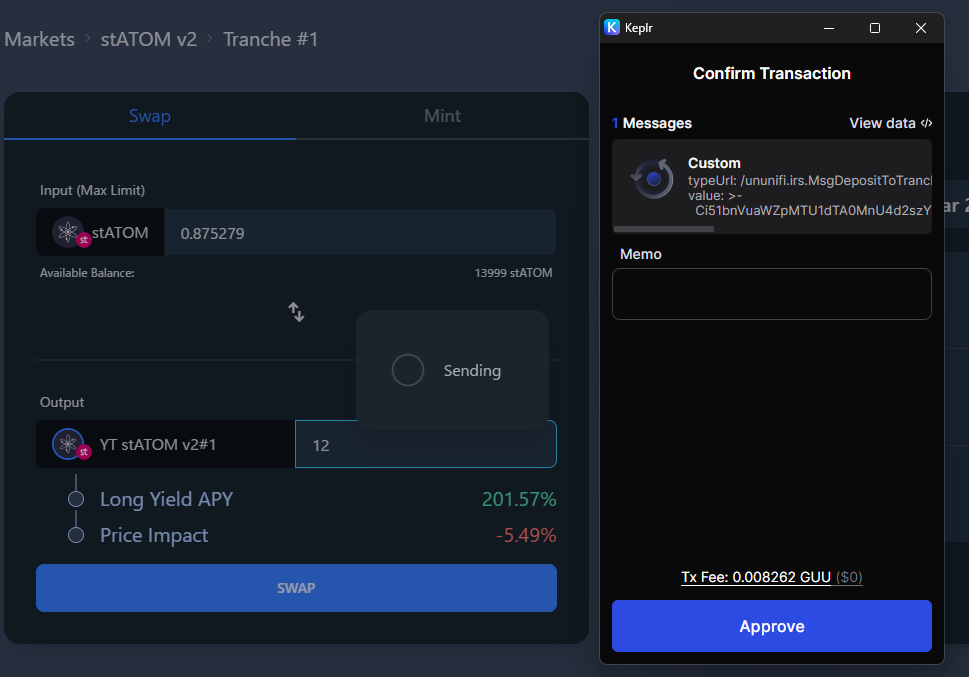

Yield Trading

Active Yield Trading can be enabled by taking advantage of the following trading

types withing the IRS module:

Earning Fixed Yield (with PT)

Long Yield (with YT)

Provide Liquidity (LP) to earn extra

yield with zero impermanent loss

yield with zero impermanent loss

Section 4.1

<

4.1 Section

Earning Fixed Yield (with PT)

2 of 4

>

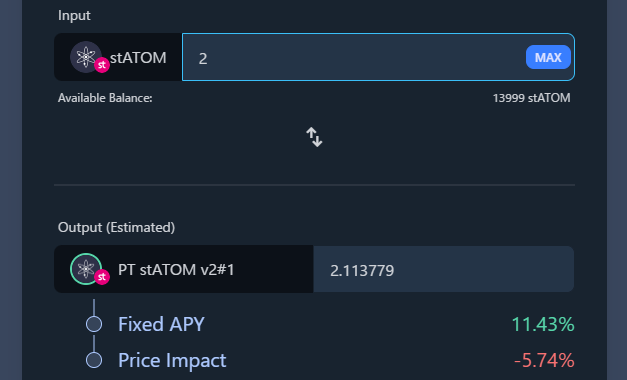

Earning Fixed Yield (with PT)

Since the value of FY is determined directly based on the price difference between

PT and the underlying asset, FY is a long PT position. When buying PT directly, the

user will always be able to buy PT at a discount, since they will not be acquiring

the PT component.

1 PT stATOM

When Buying Directly

0.99 ATOM

FY Earned:

0.01 ATOM

Buying and holding PT for Fixed Yield is more than just earning guaranteed yield. By

removing YT from the equation, the user can remove their exposure to variable yield

risk. A long PT position is a short YT position. Therefore, if the market expects

yield to decrease, the price of PT increases.

Example:

- If a user holds a long PT position, and the yield for the underlying asset decreases below the value of the APY guaranteed by the PT position, the user will net an additional profit on their position.

- The user can then sell their PT prior to Maturity to secure their profit, which is known as Active Yield Trading.

When should a user buy PT?

Naturally, buying PT when it is cheaper will guarantee a higher FY. If FY is higher

than their prediction for the future yield of the underlying asset, it is probably a

good time to acquire PT.

(If a user expects YT to drop, or the yield of the underlying asset to decrease,

acquire PT since long PT = short YT).

Section 4.2

<

4.2 Section

Long yield (YT)

3 of 4

>

Long yield (YT)

Acquiring YT tokens gives the user the right to the yield of underlying asset until

maturity. If the underlying asset generates more yield than the original purchase

price of the YT token, the holder will have secured a profit on their position.

Profit:

=

Future Yield

-

YT Cost

If the price of YT rises,

the user can also secure a profit on their position.

the user can also secure a profit on their position.

The user can sell their YT prior to maturity to secure their profit, which is known

as Active Yield Trading.

YT price always grows from the yield on underlying asset.

Leverage Yield with YT?

Leverage Yield positions occur when a user decides to acquire YT alone instead of

simply holding the underlying asset. If the user believes that APY will increase

over time, they can use the capital gained by not acquiring the underlying asset

to instead increase (leverage) their yield exposure.

- In example, let's say YT is trading at 1/10 the value of the underlying asset. Therefore 10 YT = 1 underlying asset. A user has enough capital to purchase either 1 underlying asset or 10 YT.

- If the user acquires the underlying asset, they will earn the yield generated from 1 unit of that asset, therefore they will earn a yield equal to 1 YT.

- If the user acquires 10 YT instead, they will earn the yield generated from 10 units of that underlying asset.

- If yield generated by the underlying asset decreases between the time of purchase and maturity, the value of YT decreases, and the position will result in a loss.

- Therefore, leveraging yield with YT is higher risk and subject to higher volatility, but can result in higher profits.

Section 4.3

<

4.3 Section

Provide Liquidity (LP) to earn extra yield with zero impermanent loss

4 of 4

>

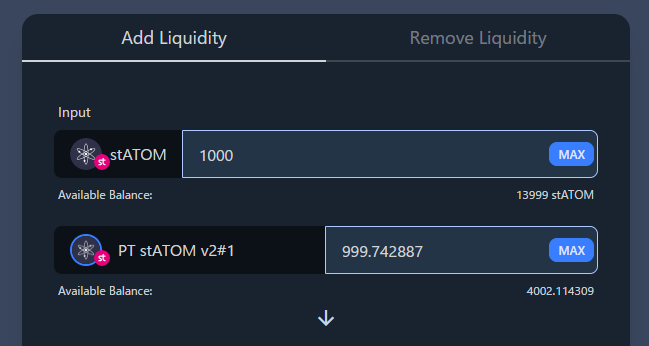

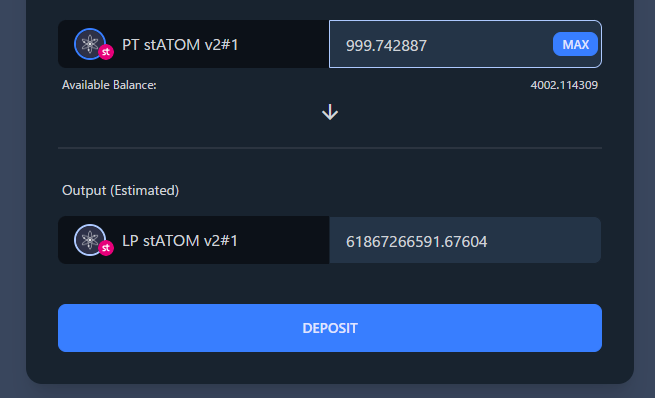

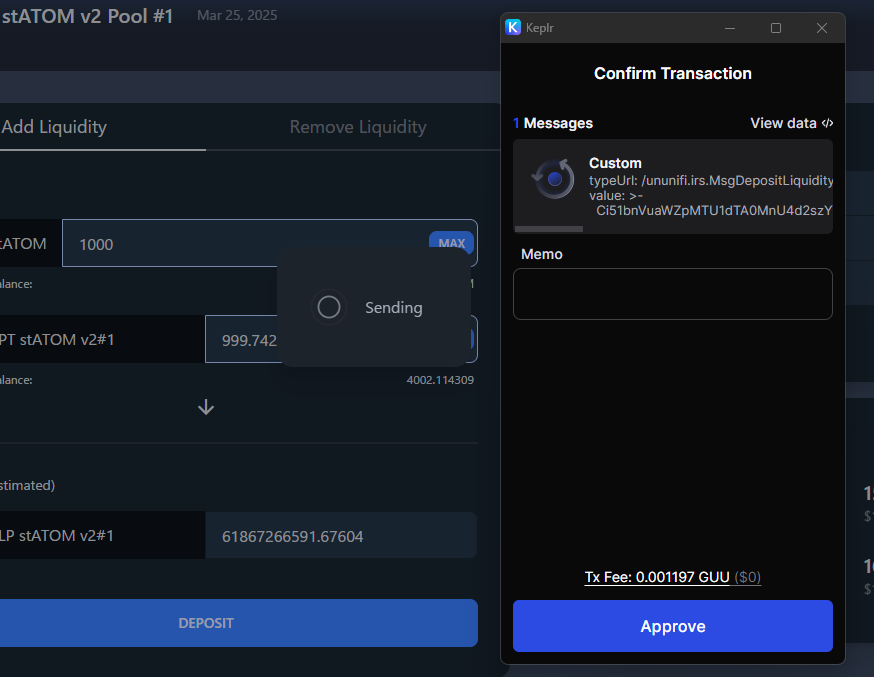

Provide Liquidity (LP) to earn extra yield with zero impermanent loss

A user can earn extra yield on top of their otherwise idle yield-bearing assets by

providing liquidity with PT. No IL at Maturity date because PT in the pool can

become 1:1 redeemable with the underlying asset.

Of course, APY is not guaranteed but capital is guaranteed when held to Maturity.

Users can exit at any time without penalties. Since there is PT in the pool, this

strategy can be seen as slightly bearish (remember long PT = short YT), therefore

providing liquidity can provide some protection against falling yields in the

underlying asset.

Additionally, since all three token types (underlying asset, PT tokens, and YT

tokens) are traded within the same pool, Liquidity Providers can earn from swap fees

for all 3 tokens.

Open App

Continue